There is a jump of more than 200% since 1970 in the number of Americans who are either obese or overweight, with around 34% of Americans as obese and nearly two-thirds being overweight. A metabolic disorder like diabetes increased 400% in the same period. According to Gary Taubes and Dr. Peter Attia of Nutrition Science, fat-free food labels are only worsening the obesity crisis. They have started causing growing concern in society as well.

Due to the reasons mentioned above, the awareness about keeping healthy and taking proper nutrition is spreading fast among people. Vitamins and supplements are more of a part of the lifestyle nowadays due to which the wellness industry is a flourishing business. GNC Holdings (GNC) and Herbalife (HLF) are popular in the wellness and dietary supplements market.

Looking at GNC

GNC's business is very well diversified and runs through three different segments – retail, franchise and manufacturing/third-party.

GNC has been growing top and bottom lines through strong comparable-store sales growth and is the least controversial of the three companies in this space, and the strong increase in consumer traffic resulted in 8.2% product comps in quarter three. In addition, GNC.com significantly exceeded the industry growth rates and delivered 31.7% comps increase this quarter.

Moreover, GNC offers a dividend that yields 1% that still has a significant room for improvement because the company has ample free cash flow with a payout ratio of 21%. The company has been good at returning money to shareholders through the share repurchase program. GNC has returned far more cash to shareholders than it raised since its IPO in April 2011; its shares have appreciated by a whopping 260% since then.

GNC acquired the UK-based web-only retailer Discount Supplements to boost growth, and expanding in the UK and other European and Scandinavian markets must accelerate growth.

The health and wellness market has been dominated by GNC for over seven decades. It has 8,100 locations in 54 countries worldwide and marvelous brand awareness. These strong reasons make GNC a trusted brand for consumers to fulfill their needs of a healthy lifestyle.

Going forward, GNC targets to maintain the store count growth of approximately 115 net new stores each year and sees potential for opening approximately 5,000 total standalone GNC stores in the U.S.

A Look at Herbalife

The global rise of obesity enabled Herbalife to record net sales of $1.2 billion, 19% above last year's third quarter. However, Herbalife's marketing practice, like all other direct-selling through individual distributors is questionable.

But Herbalife has received good recent endorsements as it won in the Belgian appeals court. The court rejected claims of Herbalife being a pyramid scheme. The court concluded that the income that its distributors earn from others recruited to buy or sell its products isn't in violation of European consumer protection laws.

So, the company looks to be a good investment option with increasing acceptance in Europe and most probably in the U.S. as well. The P/E ratio of 15 indicates that the stock is cheap with a satisfying dividend yield of 1.70%. Analysts are projecting an impressive CAGR of 15% for Herbalife for the next five years.

Conclusion

Both companies have capitalized on people's awareness about leading a healthy lifestyle. While GNC is a well-established name and oldest of the lot, Herbalife has also been making its mark. The growth expectations look promising. But the cheapest is Herbalife and it could make a good addition to your portfolio.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

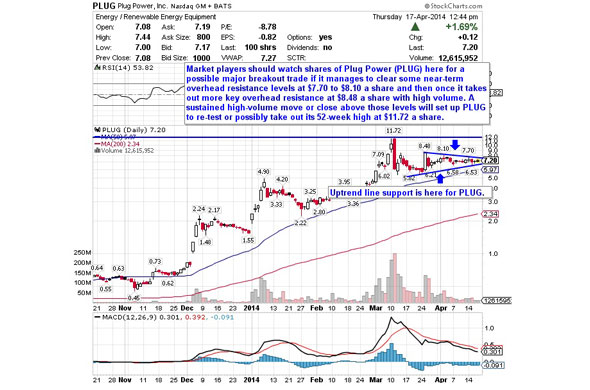

GNC STOCK PRICE CHART

44.93 (1y: +7%) $(function(){var seriesOptions=[],yAxisOptions=[],name='GNC',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1366261200000,41.81],[1366347600000,41.75],[1366606800000,41.4],[1366693200000,42.21],[1366779600000,42.98],[1366866000000,43.05],[1366952400000,44.85],[1367211600000,45.5],[1367298000000,45.33],[1367384400000,44.69],[1367470800000,45.47],[1367557200000,45.39],[1367816400000,44.89],[1367902800000,44.81],[1367989200000,45.43],[1368075600000,45.44],[1368162000000,45.98],[1368421200000,45.51],[1368507600000,45.24],[1368594000000,45.59],[1368680400000,45.3],[1368766800000,45.63],[1369026000000,45.3],[1369112400000,45.78],[1369198800000,45.65],[1369285200000,45.53],[1369371600000,45.7],[1369717200000,45.83],[1369803600000,44.75],[1369890000000,45.51],[1369976400000,45.03],[1370235600000,44.44],[1370322000000,43.96],[1370408400000,43.85],[1370494800000,44.1],[1370581200000,44.8],[1370840400000,45.31],[1370926800000,45.83],[1371013200000,45.62],[1371099600000,46],[1371186000000,46],[1371445200000,46.88],[1371531600000,47.93],[1371618000000,47.48],[1371704400000,47.01],[1371790800000,46.71],[1372050000000,45.61],[1372136400000,46.11],[1372222800000,46.55],[1372309200000,45.14],[1372395600000,44.21],[1372654800000,45.29],[1372741200000,45.88],[1372827600000,46.19],[1373000400000,46.7],[1373259600000,46.52],[1373346000000,46.78],[1373432400000,47.29],[1373518800000,47.76],[1373605200000,46.95],[1373864400000,47.02],[1373950800000,47.34],[1374037200000,47.48],[1374123600000,47.24],[1374210000000,47.42],[1374469200000,47.69],[1374555600000,47],[1374642000000,46.64],[1374728400000,51.72],[1374814800000,52.87],[1375074000000,52.97],[1375160400000,52.18],[1375246800000,52.78],[1375333200000,53.38],[1375419600000,54.5],[1375678800000,54.29],[1375765200000,53.47],[1375851600000,52.51],[1375938000000,52.09],[1376024400000,52.56],[1376283600000,53.28],[1376370000000,53.24],[1376456400000,53.04],[1376542800000,52.72],[1376629200000,51.67],[1376888400000,51.57],[1376974800000,51.68],[137706120000! 0,50.77],[1377147600000,51.24],[1377234000000,51.25],[1377493200000,51.37],[1377579600000,50.31],[1377666000000,50.88],[1377752400000,51.52],[1377838800000,50.87],[1378184400000,50.74],[1378270800000,51.08],[1378357200000,52.01],[1378443600000,52.85],[1378702800000,53.46],[1378789200000,53.35],[1378875600000,54.44],[1378962000000,53.02],[1379048400000,52.71],[1379307600000,53.24],[1379394000000,52.9],[1379480400000,52.99],[1379566800000,52.8],[1379653200000,53.32],[1379912400000,53.88],[1379998800000,53.87],[1380085200000,53.73],[1380171600000,54.17],[1380258000000,54.31],[1380517200000,54.63],[1380603600000,55.65],[1380690000000,54.7],[1380776400000,54.27],[1380862800000,55.05],[1381122000000,54.46],[1381208400000,53.61],[1381294800000,53],[1381381200000,54.1],[1381467600000,54.98],[1381726800000,54.68],[1381813200000,54.67],[1381899600000,55.5],[1381986000000,55.6],[1382072400000,55.92],[1382331600000,56.01],[1382418000000,56.13],[1382504400000,57.14],[1382590800000,56.57],[1382677200000,58.9],[1382936400000,59.27],[1383022800000,58.81],[1383109200000,58.59],[1383195600000,58.82],[1383282000000,58.98],[1383544800000,59.05],[1383631200000,59.76],[1383717600000,58.88],[1383804000000,57.61],[1383890400000,57.88],[1384149600000,59.06],[1384236000000,59.7],[1384322400000,59.67],[1384408800000,58.85],[1384495200000,59.63],[1384754400000,59.76],[1384840800000,59.43],[1384927200000,58.15],[1385013600000,58.53],[1385100000000,58.83],[1385359200000,58.25],[1385445600000,58.65],[1385532000000,60.56],[1385704800000,60.18],[1385964000000,59.4],[1386050400000,59.33],[1386136800000,58.98],[1386223200000,58.68],[1386309600000,59.14],[1386568800000,58.16],[1386655200000,57.72],[1386741600000,57.7],[1386828000000,57.93],[1386914400000,58.05],[1387173600000,58.14],[1387260000000,57.77],[1387346400000,58.48],[1387432800000,58.6],[1387519200000,57.51],[1387778400000,57.68],[1387864800000,57.98],[1388037600000,58.28],[1388124000000,57.96],[1388383200000,58.32],[1388469600000,58.45],[1388642400000,57.72],[1388728800000,56.7! ],[138898! 8000000,56.19],[1389074400000,56.64],[1389160800000,57.27],[1389247200000,56.15],[1389333600000,55.76],[1389592800000,54.51],[1389679200000,55.4],[1389765600000,56.12],[1389852000000,54.41],[1389938400000,53.09],[1390284000000,52.55],[1390370400000,53.76],[1390456800000,52.48],[1390543200000,52.24],[1390802400000,51.33],[1390888800000,50.85],[1390975200000,50.09],[1391061600000,50.85],[1391148000000,51.11],[1391407200000,49.02],[1391493600000,50.62],[1391580000000,49.35],[1391666400000,50.69],[1391752800000,51.16],[1392012000000,51.04],[1392098400000,51.89],[1392184800000,52.17],[1392271200000,52.39],[1392357600000,44.72],[1392703200000,44.45],[1392789600000,44.76],[1392876000000,45.57],[1392962400000,46.91],[1393221600000,46.6],[1393308000000,48.37],[1393394400000,48.29],[1393826400000,47.61],[1393912800000,48.23],[1393999200000,48.4],[1394085600000,47.66],[1394172000000,48.22],[1394427600000,48.4],[1394514000000,48.04],[1394600400000,47.62],[1394686800000,46.74],[1394773200000,46.55],[1395032400000,45.24],[1395118800000,44.59],[1395205200000,44.5],[1395291600000,44.25],[1395378000000,44.23],[1395637200000,43.43],[1395723600000,43.52],[1395810000000,43.2],[1395896400000,43.23],[1395982800000,44.13],[1396328400000,45.68],[1396414800000,46.26],[1396501200000,46.64],[1396587600000,45.99],[1396846800000,45],[1396933200000,45.09],[1397019600000,45.89],[1397106000000,44.51],[1397192400000,44.26],[1397451600000,43.92],[1397538000000,44.55],[1397624400000,45.23],[1397710800000,44.93],[1397793538000,44.93],[1397793538000,44.93],[1397746875000,44.93]]};var reporting=$('#reporting');Highcharts.setOptions({lang:{rangeSelectorZoom:""}});var chart=new Highcharts.StockChart({chart:{renderTo:'container_chart',marginRight:20,borderRadius:0,events:{load:function(){var chart=this,axis=chart.xAxis[0],buttons=chart.rangeSelector.buttons;function reset_all_buttons(){$.each(chart.rangeSelector.buttons,function(index,value){value.setState(0);});series=chart.get('GNC');series.remove();} buttons[0].on('click',function(e){chart.showLoading();reset_all_buttons();chart.rangeSelector.buttons[0].setState(2);var extremes=axis.getExtremes();$.getJSON('/modules/chart/price_chart_json.php?symbol=GNC&ser=1d',function(data){if(data!=null){var extremes=axis.getExtremes();axis.setExtremes(data[1][0][0],data[1][data[1].length-1][0]);chart.addSeries({name:'GNC',id:'GNC',color:'#4572A7',data:data[1]});if(data[0][1]>=0){display=data[0][0]+" (1D: +"+data[0][1]+"%)";reporting.html(display);}else{display=data[0][0]+" (1D: "+data[0][1]+"%)";reporting.html(display);} chart.hideLoading();}});})