That��s because travelers are as happy as they��ve been with North American carriers in years, according to the latest North American Customer Satisfaction Study out Wednesday from J.D. Power.

Improvements to planes, baggage handling,�and even the application of those infamous airline fees are all areas in which customer satisfaction has increased, according to J.D. Power. In fact, J.D. Power said it recorded ��record-high customer satisfaction�� in its 2018 report, the 14th annual study by the group.

��With a single exception, airlines in North America show consistent improvements across all the factors, from booking a ticket to handling luggage,�� Michael Taylor, Travel Practice Lead at J.D. Power, said in a statement accompanying the group��s survey results for 2018.�

Passengers' happiness with service on U.S. and Canadian airlines rose for the seventh consecutive year, hitting its highest�mark since J.D. Power moved to its current survey format in 2006. The industry's satisfaction score climbed to an average of 762 on a 1,000-point scale -- a six-point jump from the previous record high set last year.

IN PICTURES: 43 cool aviation photos

FacebookTwitterGoogle+LinkedIn43 cool aviation pics: Boeing 747s to retro flight attendants to A380s Fullscreen Post to FacebookPosted!

Post to FacebookPosted!A link has been posted to your Facebook feed.

United Airlines flight attendants dress in 1970's retro uniforms aboard the carrier's last Boeing 747 passenger flight on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

United Airlines flight attendants dress in 1970's retro uniforms aboard the carrier's last Boeing 747 passenger flight on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen United Airlines flight 747 takes off from San Francisco International Airport as it travels to Honolulu on its final passenger flight on Nov. 7, 2017. Justin Sullivan, Getty ImagesFullscreen

United Airlines flight 747 takes off from San Francisco International Airport as it travels to Honolulu on its final passenger flight on Nov. 7, 2017. Justin Sullivan, Getty ImagesFullscreen Hawaiian Airlines Boeing 717 jets park at the inter-island terminal at Honolulu International Airport on Nov. 8, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

Hawaiian Airlines Boeing 717 jets park at the inter-island terminal at Honolulu International Airport on Nov. 8, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A make-up artist applies make-up to a United Airlines flight attendant dressed in a retro 1970s-themed uniform before taking part in the final Boeing 747 flight for the airline on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A make-up artist applies make-up to a United Airlines flight attendant dressed in a retro 1970s-themed uniform before taking part in the final Boeing 747 flight for the airline on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen An Aer Lingus Boeing 757-200 lands at Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

An Aer Lingus Boeing 757-200 lands at Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A Cathay Pacific flight readies for take off from Hong Kong on Nov. 8, 2017. Anthony Wallace, AFP/Getty ImagesFullscreen

A Cathay Pacific flight readies for take off from Hong Kong on Nov. 8, 2017. Anthony Wallace, AFP/Getty ImagesFullscreen Mechanic Ron Lostica poses for a photo onboard United Airlines' last Boeing 747 jet before it made its final passenger flight on Nov. 7, 2017. Mr. Lostica, a 31-year United veteran, wore a Boeing 747 hat from a delivery in the 1990s. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

Mechanic Ron Lostica poses for a photo onboard United Airlines' last Boeing 747 jet before it made its final passenger flight on Nov. 7, 2017. Mr. Lostica, a 31-year United veteran, wore a Boeing 747 hat from a delivery in the 1990s. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A Spirit Airlines Airbus A320 departs Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A Spirit Airlines Airbus A320 departs Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen Lufthansa's retro-painted Boeing 747-8i lands at Seattle-Tacoma International Airport in December 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

Lufthansa's retro-painted Boeing 747-8i lands at Seattle-Tacoma International Airport in December 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A JetBlue Embraer E190 lands at Worcester Regional Airport in central Massachusetts on Nov. 24, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A JetBlue Embraer E190 lands at Worcester Regional Airport in central Massachusetts on Nov. 24, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen Sean Worsley and Christine Ellis embrace after Mr. Worsley asked Ms. Ellis to marry him aboard United Airlines last Boeing 747 passenger flight on Nov. 7, 2017. She said 'yes.' Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

Sean Worsley and Christine Ellis embrace after Mr. Worsley asked Ms. Ellis to marry him aboard United Airlines last Boeing 747 passenger flight on Nov. 7, 2017. She said 'yes.' Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A cabin crew member aboard United Airlines last Boeing 747 flight takes the 1970s retro-theme to heart on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A cabin crew member aboard United Airlines last Boeing 747 flight takes the 1970s retro-theme to heart on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen An Aeromexico jet sits on the tarmac at Mexico City's international airport on Nov. 28, 2017. Pedro Pardo, AFP/Getty ImagesFullscreen

An Aeromexico jet sits on the tarmac at Mexico City's international airport on Nov. 28, 2017. Pedro Pardo, AFP/Getty ImagesFullscreen A Horizon-operated Embraer E170 jet, flying for Alaska Airlines, lands at Seattle-Tacoma International Airport in December 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A Horizon-operated Embraer E170 jet, flying for Alaska Airlines, lands at Seattle-Tacoma International Airport in December 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A Hainan Airlines Boeing 787 Dreamliner departs Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A Hainan Airlines Boeing 787 Dreamliner departs Boston Logan International Airport on Nov. 25, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A Southwest Airlines Boeing 737 MAX 8 jet lands at Seattle-Tacoma International Airport in December of 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A Southwest Airlines Boeing 737 MAX 8 jet lands at Seattle-Tacoma International Airport in December of 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen United Airlines last Boeing 747 rests at the gate in Honolulu after completing its final passenger flight on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

United Airlines last Boeing 747 rests at the gate in Honolulu after completing its final passenger flight on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A passenger aboard United Airlines last Boeing 747 flight poses for a portrait on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen

A passenger aboard United Airlines last Boeing 747 flight poses for a portrait on Nov. 7, 2017. Jeremy Dwyer-Lindgren, special to USA TODAYFullscreen A flight of Australian low-cost carrier JetStar taxis at Sydney's Kingsford Smith International Airpor on Nov. 27, 2017. Daniel Munoz, EPA-EFEFullscreen

A flight of Australian low-cost carrier JetStar taxis at Sydney's Kingsford Smith International Airpor on Nov. 27, 2017. Daniel Munoz, EPA-EFEFullscreen

Cavalier Investments LLC lifted its stake in shares of Consumer Discretionary SPDR (NYSEARCA:XLY) by 67.9% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 184,419 shares of the exchange traded fund’s stock after buying an additional 74,598 shares during the quarter. Consumer Discretionary SPDR makes up approximately 6.6% of Cavalier Investments LLC’s portfolio, making the stock its 5th biggest position. Cavalier Investments LLC owned 0.15% of Consumer Discretionary SPDR worth $18,680,000 at the end of the most recent reporting period.

Cavalier Investments LLC lifted its stake in shares of Consumer Discretionary SPDR (NYSEARCA:XLY) by 67.9% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 184,419 shares of the exchange traded fund’s stock after buying an additional 74,598 shares during the quarter. Consumer Discretionary SPDR makes up approximately 6.6% of Cavalier Investments LLC’s portfolio, making the stock its 5th biggest position. Cavalier Investments LLC owned 0.15% of Consumer Discretionary SPDR worth $18,680,000 at the end of the most recent reporting period.

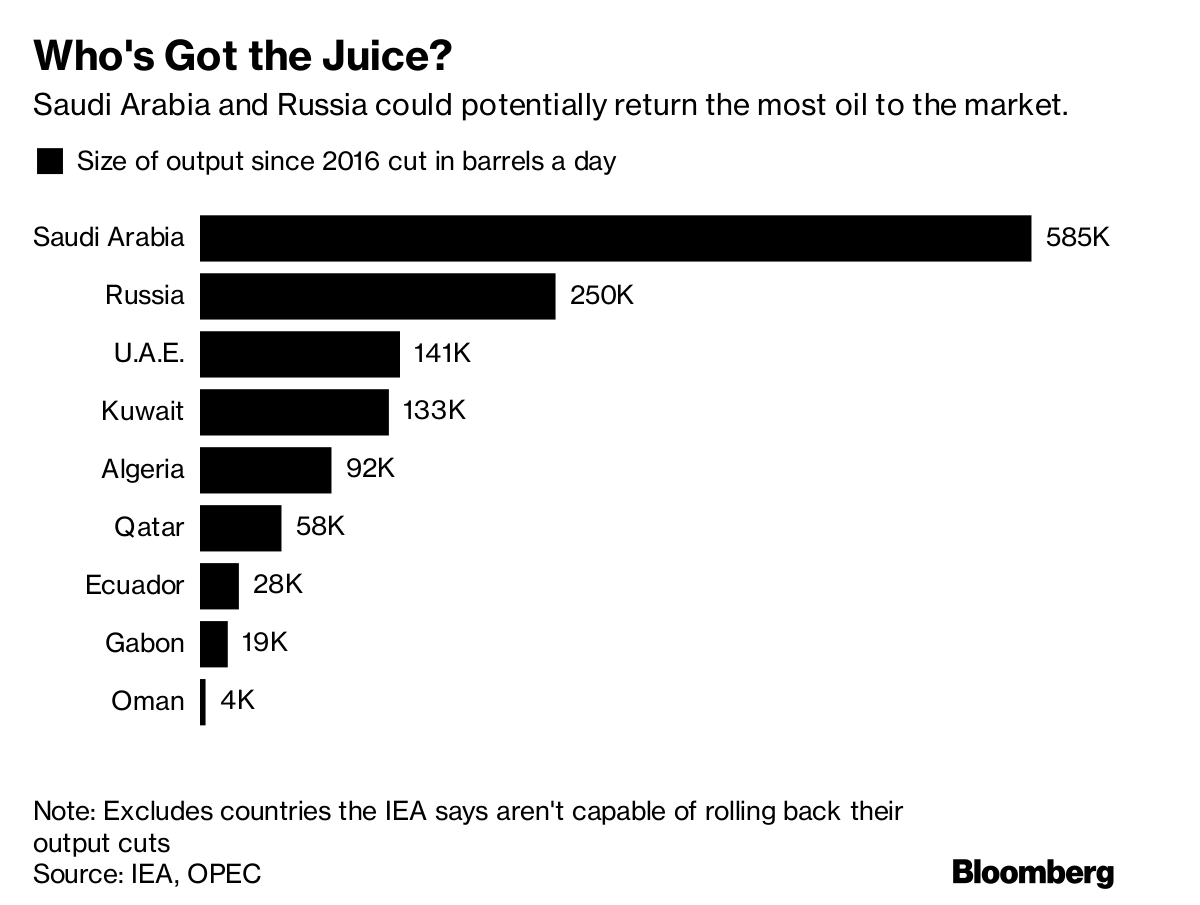

Excessive Cuts

Excessive Cuts Vertical Research assumed coverage on shares of Hostess Brands (NASDAQ:TWNK) in a research report sent to investors on Monday morning. The brokerage issued a buy rating on the stock.

Vertical Research assumed coverage on shares of Hostess Brands (NASDAQ:TWNK) in a research report sent to investors on Monday morning. The brokerage issued a buy rating on the stock.